Do I Have to Pass My Theory Test Before Learning to Drive?

Find out whether you need to pass your theory test before you start learning to drive and what other requirements are needed.

When you’re shopping for car insurance, there are plenty of factors that determine the price you’ll pay, from the type of car you drive to your age and location. But what about car mileage? Does car mileage affect insurance costs, and if so, how? In this guide, we’ll break down everything you need to know about the relationship between mileage and car insurance. Whether you’re a learner driver or a seasoned driver, understanding how mileage brackets and annual mileage impact your car insurance price can help you make the right choices for your budget.

Car mileage refers to the total distance a car has travelled since it was first used, typically measured in miles. You’ll often find this number on the car’s odometer. In the context of car insurance, mileage can refer to either the car’s current mileage or the projected annual mileage – the total distance the car is expected to travel within a year. Insurance companies consider both numbers because they give insight into how much a car is on the road, which can help determine the likelihood of it being involved in an accident.

For many car insurance providers, high mileage is seen as a risk factor. In other words, the more miles driven, the higher the chance of an accident or mechanical failure, both of which impact the cost of car insurance. On the contrary, low-mileage drivers may qualify for discounts or “low mileage” insurance plans that reduce costs.

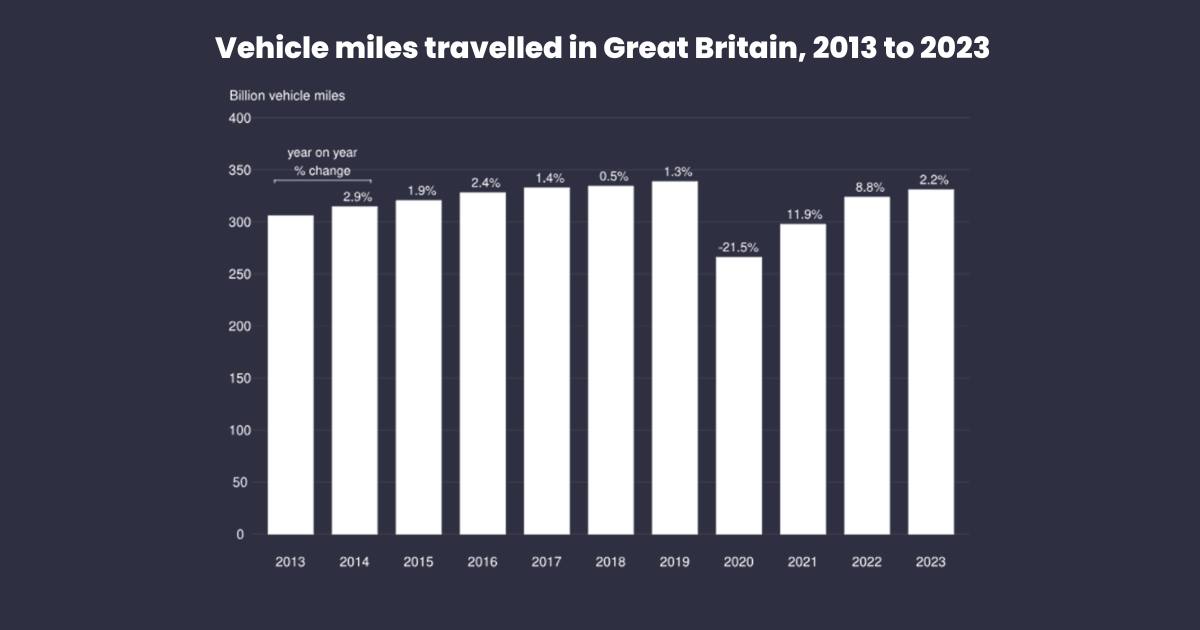

Source: https://www.britanniacarleasing.co.uk/news/annual-uk-car-mileage/

Yes, the price of car insurance is influenced by car mileage, often significantly. Car insurance providers generally consider both annual mileage and total mileage in their risk assessment, as they are key indicators of a driver’s likelihood of making a claim. Let’s break down how mileage affects car insurance prices across several factors:

Many insurers categorise drivers based on mileage brackets, such as 0-5,000 miles, 5,001-10,000 miles, and so on. Drivers in the lowest mileage brackets typically pay less for insurance than those who cover more miles annually. Lower mileage suggests that the car is on the road less frequently, reducing the risk of accidents, theft, and other incidents, which is why insurers often offer lower premiums for drivers in lower mileage brackets.

The more time a car spends on the road, the higher the risk of being involved in an accident. High-mileage drivers are statistically more likely to experience wear and tear on their vehicle, which can also lead to costly repairs. Insurance companies consider this increased risk when setting premiums, meaning higher mileage can potentially lead to a more expensive insurance policy.

High mileage also correlates with faster depreciation of the car’s value due to wear and tear. As vehicles age and accumulate miles, they are more likely to encounter mechanical problems that lead to claims. Insurance providers take this depreciation into account since it affects both the value of the car and the likelihood of claims, especially on comprehensive insurance policies.

Some insurers may ask for an estimate of your annual mileage during the quote process or even offer policies tailored to specific mileage amounts. It’s important to provide an accurate estimate, as underestimating can lead to denied claims or rate increases if you exceed your stated mileage significantly.

Some insurers offer low mileage discounts or “pay-as-you-drive” policies. These can help drivers who don’t use their car frequently to save money. If you’re able to limit your mileage, these policies could be a cost-effective solution to keep your car insurance premiums low.

Source: https://www.gov.uk/government/statistics/road-traffic-estimates-in-great-britain-2023/road-traffic-estimates-in-great-britain-2023-headline-figures

This graph tells us that the number of vehicle miles travelled in Great Britain was on a year-on-year increase up until 2020, which was the start of COVID-19. Since 2020 though, we have seen a steady increase back towards pre-pandemic levels.

Car mileage is just one factor among many that insurance companies consider when setting premiums. Here are five other common factors that can impact car insurance price:

Young or new drivers tend to pay higher premiums due to their lack of experience on the road. As drivers gain experience and reach age milestones, insurance costs typically decrease.

The car’s make, model, and year all affect insurance prices. Generally, high-performance vehicles, luxury cars, and cars with high repair costs have higher premiums.

A driver’s history of penalty points, and claims plays a crucial role in determining premiums. Having no accident claims on an insurance policy can result in discounts being offered when it comes to policy renewal. On the contrary, having to make an accident claim on your insurance can often increase the price of your policy.

The type and level of coverage you choose significantly affect your insurance costs. Comprehensive coverage, which offers more extensive protection, generally costs more than third-party or basic policies. This allows drivers some flexibility to choose a plan that suits their budget and protection needs, as higher levels of coverage provide added security but come at a higher price.

Reducing your mileage can not only help lower your car insurance but can also save you money on fuel and maintenance. Here are three strategies to consider:

Carpooling with friends, family, or colleagues can significantly reduce the miles you put on your car. Public transportation is also a great option if available, cutting down both mileage and commuting costs.

For those with flexible work arrangements, working from home, even part-time, can help reduce annual mileage. This could be particularly beneficial for drivers who previously commuted long distances every day.

Planning your errands and combining multiple stops into one trip can minimise your driving distance. By reducing the number of short, frequent trips, you’ll limit your car’s mileage, save on fuel, and decrease wear and tear.

In summary, car mileage does indeed affect car insurance costs, and understanding this relationship can help you make smarter decisions when purchasing insurance. High-mileage drivers tend to face higher premiums due to the increased risk associated with more time on the road, while low-mileage drivers may benefit from discounts or specialised plans. By managing your mileage and being aware of other key factors that impact insurance rates, you can work toward finding an insurance policy that fits both your budget and lifestyle.

Commonly asked questions about car mileage

es, annual mileage is a significant factor that insurers consider when calculating premiums. Lower mileage often leads to lower premiums, while high-mileage drivers may face increased rates due to the associated risks.

Yes, annual mileage is a significant factor that insurers consider when calculating premiums. Lower mileage often leads to lower premiums, while high-mileage drivers may face increased rates due to the associated risks.

If you’re unsure, start by tracking your weekly mileage and multiplying by 52 weeks. Alternatively, use past MOT records for a better annual estimate.

Many insurers view around 5,000 to 7,000 miles per year as low mileage, though this can vary. Drivers with lower annual mileage may sometimes qualify for reduced premiums due to decreased road risk however this is not guaranteed.

Yes, many insurers allow you to adjust your mileage estimate if your driving habits change, especially if you are driving significantly more or less than expected.

Some insurers offer “pay-as-you-go” or low-mileage-specific policies. These are ideal for people who don’t drive frequently, as they allow you to pay based on actual mileage.

You will be logged out in seconds. Do you want to stay signed in?