Last Updated on March 20, 2025

When you are learning to drive, there are many costs to consider. Insurance companies often view new drivers as a high risk. This is because, they are new on the road and do not have much experience at first. As you get older, earn a no claims bonus and have more experience with driving premiums will often reduce.

However, if you pass your test, you may be able to reduce the cost of your first full licence insurance! By getting a No Claims bonus before you pass!

Contents

What is a No Claims bonus?

Can a learner driver earn a no claims bonus?

Will a no claims discount save me money on full licence insurance?

Conclusion

What is a No Claims Bonus?

A No Claims Bonus (NCB), sometimes referred to as a No Claims Discount (NCD) lets an insurer know that you have had no fault claims on the policy. Letting them know you are a safe driver.

Depending on the number of years you are claims free, you can accumulate your NCB, for example driving for 4 years without any claims, you build up a 4 year NCB. This can reduce your premium by 30%, rising to 60%–65% according to the British Insurance Broker’s Institute.

You will typically earn a No Claims Bonus after passing your practical driving test. When you have been on the road for at least one year with no claims. Although, this is not always the case!

If you have taken out provisional insurance while learning, you may be able to earn your own NCB. Which could help reduce the cost when you go on to pass your test. Not every Learner Insurance company will offer this, but it will be a huge advantage after you have passed your test as it could save you some money!

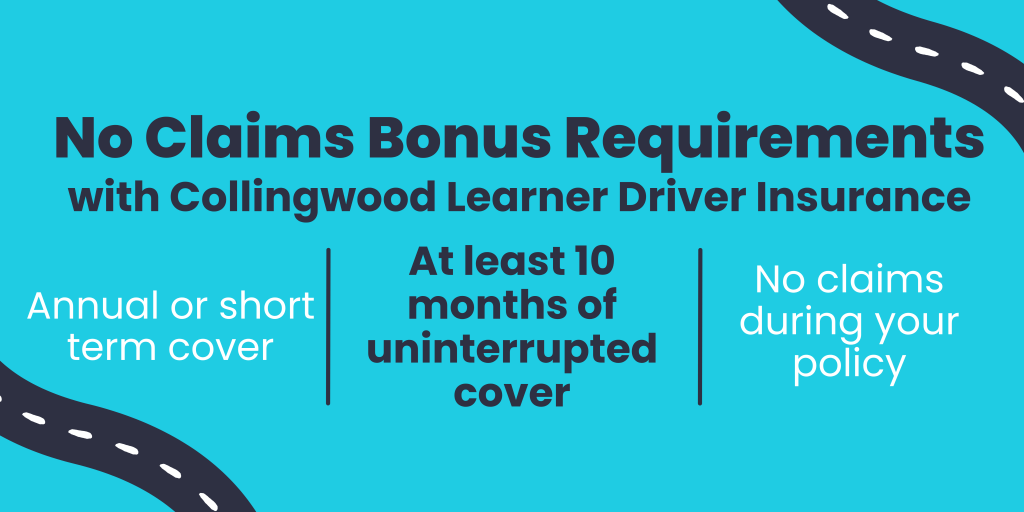

Can a learner driver earn a no claims bonus?

As a provisional licence holder, you can start to earn your own NCB before you even pass your test. With Collingwood Learner Driver Insurance, you have the potential to earn a no claims bonus. Which some insurers will consider after you pass, which can reduce your overall premium.

Even better, with a Collingwood Learners insurance policy, no claims are accelerated! Meaning, if you achieve 10 months of uninterrupted cover, with no claims on the policy, you can earn your own accelerated NCB. This can be 10 months of an annual policy or a short-term policy with no breaks in cover!

By being a safe driver and meeting all the terms and conditions of your policy, you could be in for a chance of reducing your first full-license insurance premium!

Top tip!

Setting up a Learner Driver Insurance policy with Collingwood as soon as you start learning to drive, makes it more likely that you will be able to achieve all criteria to get your own No Claims Bonus! It may not take you 10 months to pass. However, if it does you will get the added benefit of a NCB for your full licence insurance.

You also get the added benefit of extra driving practice outside of your lessons! Which could help you pass your driving test. The DVSA recommends drivers get 45 hours of driving lessons and 22 hours of private practice.

To get your NCB you must meet all the criteria on your learner policy, and then after it has ended, you will be sent your NCB certificate. You can then pass this on to your next insurer to potentially get a discount when you pass.

Collingwood also provides exclusive follow-on insurance to existing Collingwood customers only. With competitive pricing and the guarantee that your NCB will be considered

Will a no claims discount save me money on full licence insurance?

Having a NCD shows the insurer that you are a responsible driver and can drive safely. Therefore, it may reduce premiums after you pass.

Not every insurer will acknowledge an NCD from a learner policy. So, it is a good idea to ask and look around when you are setting up your full licence insurance for an insurer that will consider your NCB or accelerated no claims bonus.

When your Collingwood Insurance policy ends your no claims sent to you by email. Once you have passed your test, your learner driver policy is no longer valid. Make sure this is cancelled before insuring your car as a full licence holder!

Conclusion

As a learner driver, there are ways that you can earn a No claims discount which can help you save money when you move on to full licence insurance. This is subject to you meeting specific criteria for your policy, which will allow you to achieve your own no claims discount.

With Collingwood you know that you have a chance to earn your own NCD with 10 months of uninterrupted cover without any claims on the policy. This will give you potential savings after you have passed your driving test.

After passing, it is always a good idea to shop around for the best deal and look for an insurer who will accept your Learner’s NCB. To make sure that you will get a discount on your policy!

To guarantee your NCB as a learner it is best practice to set up insurance as soon as you want to learn to drive. This gives you the most amount of time covered and will set you up better for earning your discount. It also gives you extra driving practice to help you feel more prepared for your test!

Get a learner driver insurance quote today!