Annual Provisional Car Insurance

With Collingwood annual provisional car insurance, you can drive your own, a family member or friend's car for up to 12 months, which could be enough time to learn to drive and pass your practical driving test.

Costing from as little as 59p/day, and without risking the car owner's No Claims Bonus**, learner insurance for the year could boost your skills and confidence. See Collingwood's competitive rates, get your quote below then get on the road!

What is annual provisional car insurance?

Annual provisional car insurance is a type of learner car insurance that can last up to 12 months from the start of the policy. Typically, learner drivers use it to practice driving alongside a friend or family member in the car, either in their own car, or the other party's.

This type of insurance is for UK provisional licence holders that want plenty of time to practice privately alongside driving lessons. For those who have been taking lessons for a while and aim to pass soon, short-term provisional insurance can sometimes be a better choice.

Once the learner driver passes their practical driving test, the annual provisional car insurance must be cancelled.

What are the benefits of Annual Learner Driver Insurance ?

Flexible Payments

Pay monthly or annually for annual learner driver car insurance – whatever suits your finances and learning plans.

Accelerated No Claims Bonus**

Build your No Claims Bonus before you start to drive on your own if you manage 10 months' uninterrupted, claim-free cover.**

Choose Your Cover

Unlike other insurance providers we let you choose from Fully Comprehensive, Third Party Fire and Theft or Third Party Only types of cover.

Easy to Cancel

Passed your test? Once you pass your driving test let us know, as learner insurance is no longer valid.

Why choose Collingwood annual provisional car insurance?

If you have just started learning how to drive, you may find an annual learner driver insurance policy is a more flexible and hassle-free way for you to get insured.

That's because instead of buying a short-term provisional car insurance policy and topping up every time you need to practice, an annual policy will cover you up until you pass your practical driving test. Once you pass your driving test, your policy must be cancelled. In addition, there are monthly or annual payment options available – whatever works best for you.

Provisional car insurance could also save you money. If you're covered for 10 months without making a claim, you can build a no-claims bonus** that may help reduce your premiums when you drive on your own.

Get a quote today!

Are there more benefits with Collingwood annual learner driver insurance?

There certainly are! While you're learning, Collingwood learner car insurance means you can practice outside of lessons, which gives you extra experience and could end up reducing the overall number of driving lessons required before taking your driving test.

Also, our annual provisional insurance comes with all the benefits of short term policies. First, the car owner's No Claims Bonus isn't affected** and there are no curfews on when you can drive your car.

And what's more, with both the Driver and Vehicle Standards Agency and driving instructors recommending that drivers spend time independently with supervision before they take their tests, learner driver insurance is crucial.

Can I choose to drive my own car or someone else's?

Insuring your own car

If you own your car as a provisional licence holder, we let you choose from various annual learner driver car insurance policies and levels of cover. You can also have your parent or spouse as a named driver, and we let you start building toward your first year's No Claims Bonus too!**

Insuring someone else's car

If you choose to insure someone else's car, a provisional insurance policy will sit alongside the existing policy of the car you're learning to drive in. Our learner car insurance lets you get insured for private practice in a friend or family member's car – a great choice if you're not planning on purchasing a car until after you've passed your test.

If I own the car, will my existing No Claims Bonus be affected?

Having a separate annual learner driver insurance policy running alongside the car owners existing policy means that if the learner driver happens to have an accident, the existing No Claims Bonus won't be affected.**

This is the advantage of taking out a separate named annual learner driver insurance policy with Collingwood, instead of adding a learner driver to your existing insurance policy.

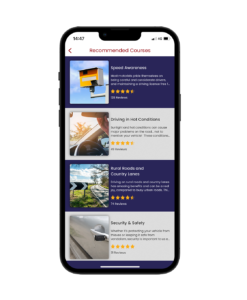

Free app for Collingwood learner drivers!

Packed with DVSA approved content, the RoadHow app can help you learn quicker and become a better and safer driver.

With RoadHow premium you'll be able to:

- Take DVSA approved theory tests

- Practice Hazard Perception clips

- Identify areas you can improve your driving

- Keep up to date with the latest road news and stories

- Rated 4.6/5 on the Apple App Store & over 10k downloads on Google Play Store

Why choose Collingwood?

✓ Excellent Customer Service – We're rated 'Excellent' on TrustPilot

✓ We're Award Winning – Recently winning the Best Motor Insurance Provider at the 2024 ICA's

✓ Competitive Insurance Quotes – We pride ourselves on affordability with Annual insurance available from 59p/day*

✓ Get a Quote in Minutes – Complete a quick form, get your quote then start learning

✓ Flexible Insurance – Choose your insurance term, from 28 – 365 days

✓ Enjoy a Free App – Download the RoadHow app to help you learn how to drive quicker

Annual Provisional Car Insurance FAQs

Get answers to all your crucial learner driver insurance questions below. We also have a more detailed FAQs section available and you can head to our blog for the latest provisional driver news, hints and tips.

How much is it to add a provisional driver to car insurance?

The cost of provisional car insurance differs depending on a range of factors, including age of the learner driver, vehicle type, vehicle age and more. Our annual insurance rates for learners start from as little as 64p per day**, and we always strive to deliver the best value for money possible.

How much is provisional insurance in the UK?

Provisional car insurance rates in the UK differ. To find out how much your cover could cost, use our simple quote calculator.

Do I need car insurance with a provisional licence?

While you must be insured to drive a car, even if you're learning, whether you need to arrange it yourself depends on how your are learning. If you are only receiving lessons from an approved driving teacher or centre, then they must arrange learner driver insurance for you – it's typically built into the cost per lesson, but if you don't know, make sure you check this with your driving instructor.

If you want to practice outside of lessons, you must be insured to drive, either in your own car or that of a friend or family member. That's when it can be a good idea to arrange provisional car insurance.

How does provisional car insurance work?

Provisional car insurance works by covering you when you're behind the wheel of your own car or that of another persons, whose vehicle must be listed on the policy.

Learner driver insurance works differently depending on the level of cover you have arranged. It must include the third party insurance, which covers damage to another person, their car or their property in the event of an accident. This can be boosted by fire and theft cover which covers loss and damage in those situations, or comprehensive cover, which covers all the above, plus any damage to the car that is purely your fault.

Are there any restrictions on when I can drive?

Unlike other insurers we don't place a curfew on when you can drive. As long as you are accompanied by a driver over the age of 21 who has held a suitable full UK (or EU, Switzerland, Liechtenstein or Iceland) driving licence for three years or more. This applies whether your learner car insurance covers you driving your own car or another person's.

Can you learn to drive as a named driver?

You can learn to drive as a named driver, but the owner of the car should be aware that their No Claims Bonus could be at risk. Provisional car insurance from Collingwood typically protects the car owner's No Claims Bonus if a learner is driving the car and has an accident.

Do I need a driver to accompany me?

Yes you do. They must be qualified to drive the car, over 21 years of age and hold a full UK, EU, Switzerland, Liechtenstein or Iceland driving licence. You must also make sure that any vehicle you are learning to drive, whether yours or someone else's, has L plates displayed on the front and back of the car.

What if I fail my driving test, will I still be covered?

If you fail your driving test, your annual provisional car insurance will still cover you, as long as less than a year has passed since the policy was purchased. Your cover will only cease when you pass your driving test, or when it reaches the point of renewal.

Learn more about annual provisional car insurance today!

If you have a question about our cover, customer service, or any other query, please don't hesitate to

Our team are always on hand to answer your questions and help you get a provisional insurance quote that gives you all the cover you need while suiting your budget. Get in touch with our helpful team over the phone, or via live chat at the bottom of the page.