Short Term Learner Driver Car Insurance

Quickly build up driving skills and confidence to pass your test with short-term car insurance for learner drivers from Collingwood.

With cover available from 28 days and the ability to top up from just seven days, you only pay for what you need – and prices start from as little as 73p/day*. Start driving in a friend or family member's car, or your own – get a short-term provisional insurance quote below!

What is short-term learner driver car insurance?

Short-term learner insurance covers your own car, or someone else's, against theft or damage while you are practising driving in it, which is a legal requirement.

Collingwood Learner Driver Insurance lets you practice driving outside of your regular lessons for a short time, such as in the run up to your test, or to overcome a specific problem you're regularly encountering during lessons – something the Driver and Vehicle Standards Agency (DVSA) specifically recommends doing. Short-term learner driver insurance can last from 28 days to 24 weeks.

Can I drive my own car or someone else's with short-term learner insurance?

Insuring Your Own Car With Short-term Cover

Own a car but only have a provisional driver licence? With Collingwood's short-term provisional car insurance, you can select different policies and cover levels and build your first year's no-claims bonus**.

Insuring someone else's car with short-term cover

Want to drive another person's car, like a friend or family member's? Short-term learner insurance sits alongside their existing car insurance policy, which means their no-claims discount is protected** while you boost your skills privately practicing in their car.

What are the benefits of short-term car insurance for learner drivers?

There are plenty of benefits to choosing a short-term provisional insurance policy, depending on your needs and circumstances.

You might find that short term learner driver insurance is more cost-effective than paying for an annual learner driver policy that covers you when you're not learning to drive, such as if you only wish to practice outside of lessons or have access to a car for a temporary period. That's because our short-term provisional insurance policies allow you to have gaps in your cover and to top up, stop and restart as and when you need.

If you're driving a friend or family members car, your short-term provisional driver cover will completely protect their no-claims discount too, and you can build your own if you gain 10 months' worth of uninterrupted, claim-free cover**.

There are two policy options with our short-term learner car insurance. Fully Comprehensive or Third-Party Fire and Theft.

All this makes short-term learner insurance a flexible option.

Get a quote today!

What are the benefits of learner's insurance on your own car?

Accelerated No Claims Bonus**

If you manage 10 months' uninterrupted, claim-free short-term learner insurance cover, you can start building your No-Claims Bonus before you drive on your own**

Flexible and Affordable

We offer cover from just 73p/day*, and you can choose from 28 days up to 4, 8, 12, 16, 20 or 24 weeks, with the ability to top up from just seven days.

Choose Your Cover Level

Choose a short-term provisional insurance cover level that suits you. Fully Comprehensive or Third Party Fire and Theft.

Protected NCD

If you’re taking out short-term learner insurance to drive someone else’s car, their no-claims discount is safe should you need to make a claim.**

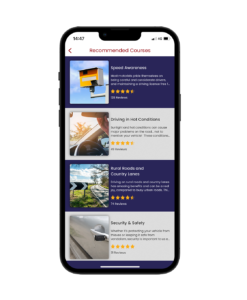

Free app for Collingwood learner drivers!

Packed with DVSA approved content, the RoadHow app can help you learn quicker and become a better and safer driver.

With RoadHow premium you'll be able to:

- Take DVSA approved theory tests

- Practice Hazard Perception clips

- Identify areas you can improve your driving

- Keep up to date with the latest road news and stories

- Rated 4.7/5 on the Apple App Store & over 10k downloads on Google Play Store

Why choose Collingwood learner driver insurance?

✓ Award Winning Insurance – Recently winning the Best Motor Insurance Provider at the 2024 ICA’s

✓ Supporting Driver Development –We work with organisations such as the DIA and MSA (The Motor Schools Association of Great Britain). We’ve also supported the Big Learner Relay for Children In Need for the past five years.

✓ Get a Quote in Minutes – Complete a quick form, get your quote then start learning

✓ Enjoy a Free App – Download the RoadHow app to help you learn how to drive quicker

Learner driver insurance FAQs

Get answers to all your crucial learner driver insurance questions below. We also have a more detailed FAQs section available and you can head to our blog for the latest provisional driver news, hints and tips.

Do learner drivers need insurance?

If you drive your own car or a family member or friend's vehicle while you have a provisional licence, before you pass your test, you need to get insurance. You can either get added to the car owner's insurance, or get dedicated learner driver's insurance, which preserves the owner's No Claims Bonus.

How much is learner driver insurance?

While our provisional insurance quotes differ depending on a range of factors, including the type and age of the vehicle and age of the learner, our cheap insurance rates start from as little as £1.04p* per day for short-term policies. Making them affordable for learners on a wide range of budgets.

Do I need insurance to supervise a learner driver?

If you want to supervise a learner driver, both of you must be insured if you are driving your car. If the learner owns their own car, then they must be covered, but you must be over 21, qualified to drive the car, and have a full licence for three years in the UK, EU, Switzerland, Liechtenstein or Iceland – you do not need to be insured on their car however.

Can I add a learner driver to my insurance?

In most cases, you can, though it depends on the specifics of your insurance policy. However, by not choosing owner learner driver insurance, you can risk your No Claims Bonus – such as if the learner bumps another car or otherwise damages your car. That's why learner insurance is often a better option than simply adding a driver.

As a vehicle owner, do I need to have my own insurance policy on the vehicle that the learner driver is insuring?

Yes, as the registered owner or keeper of the vehicle, you must have the vehicle insured in your own name for the duration of the Collingwood Learner Driver insurance policy. A “driving other cars" extension does not qualify as adequate vehicle insurance.

As the vehicle owner, must I supervise the Provisional Driving Licence Holder if they are driving my car?

Not necessarily, no. The learner driver must be accompanied by a person over the age of 21, who has held (and still holds) a valid full UK driving licence in the same category as the vehicle they are driving, for at least 3 years – it doesn't just have to be the vehicle owner.

What if I drive without learner driver insurance?

If you don't have specialised UK learner insurance or haven't been added to the insurance of the owner of the car you are driving, you could get an unlimited fine, up to eight penalty points on your licence, and be banned from driving. It's illegal to drive without valid insurance in the UK.

Is learner driver insurance the same as dual insurance?

Dual insurance is a situation where a car has the exact same cover across multiple insurance policies – such as if a car were to be insured for two people across two main policies instead of a main policyholder simply adding a named driver. Learner insurance differs from this in that it is a different type of cover. That means it still offers value for money.

Can I get learner's insurance if I'm 17 years old?

Yes, you can. All Collingwood's learner driver insurance policies can be used by or cover 17-year-old drivers.

What is the excess on learner driver insurance?

It can differ. Your specific insurance schedule will detail how much your excess is. For more information, chat to us via LiveChat below.

Do you need L plates for provisional insurance?

Yes, you do. Your car, or the car you are named on, should be fitted with front and rear L plates – or D plates if you are in Wales.

Can ANPR detect provisional insurance?

Automatic Number Plate Recognition (ANPR) is used to detect whether a car is insured, taxed, and has a valid MOT, but it cannot detect who is driving the car and the level of insurance that driver has.

However, if a car is found to have been driven by someone with the incorrect insurance or no insurance at all, you could be fined a fixed £300 penalty and be given six penalty points, receive an unlimited fine, or even be disqualified from driving indefinitely.

Is learner driver insurance different to provisional insurance?

Learner driver insurance and provisional licence insurance are the same thing. They each cover a learner driver while they practice driving with a friend or family member, in their own car, or the other person's car.

Can more than one learner driver be on the same policy?

Each learner driver is required to hold their own insurance policy. However, more than one learner driver can drive the same car.

Can I take my driving test in my own car?

Yes. You will need to take your learner insurance policy documents with you and ensure the car meets certain requirements set by the government. We've provided a summary below, but we advise that you read the full list of requirements on the government website.

- The car must be taxed.

- The car must be in a roadworthy condition.

- If the car is over three years old, it must have a current MOT.

- There must not be any warning lights lit up, for example the airbag warning light.

Can I earn a No Claims Discount while I learn to drive?

While you will not earn a traditional No Claims Discount, following the termination of your learner driver insurance policy and having completed at least 10 consecutive month of claim-free driving, we will provide a letter on a single occasion confirming an entitlement to one year's worth of No Claims Discount for presentation to a new insurer.** It's worth noting that these are not done automatically and must be requested.

Can I purchase Collingwood Learner Driver Insurance on more than one vehicle?

You can cover more than one vehicle, providing you purchase a separate policy for each vehicle. Log in to your existing online account and click 'New Quote' to begin the process.

I haven't found a driving instructor yet, can Collingwood help with that?

While we can't specifically recommend a driving instructor to suit your requirements, we do have our handy Find an Instructor tool. All you need to do is enter your postcode and our helpful tool will locate driving instructors that are close to you.

Discover more about short-term provisional car insurance

Want to know more about short-term provisional car insurance, our cover to customer service? See how you can get in touch with our experts, or talk to us right away using the LiveChat button at the bottom of the screen.

*Price correct from 11/03/2025 excludes IPT and admin fees.

**Subject to terms, conditions and underwriting criteria.